Commercial loan amortization

This fact however is often not obvious. From September 4 through December 31 she must treat 40000 of the loan as used for personal purposes 20000 as used in the passive activity and 40000 as property held for investment.

Excel Loan Amortization Table Spreadsheet Schedule Calculator

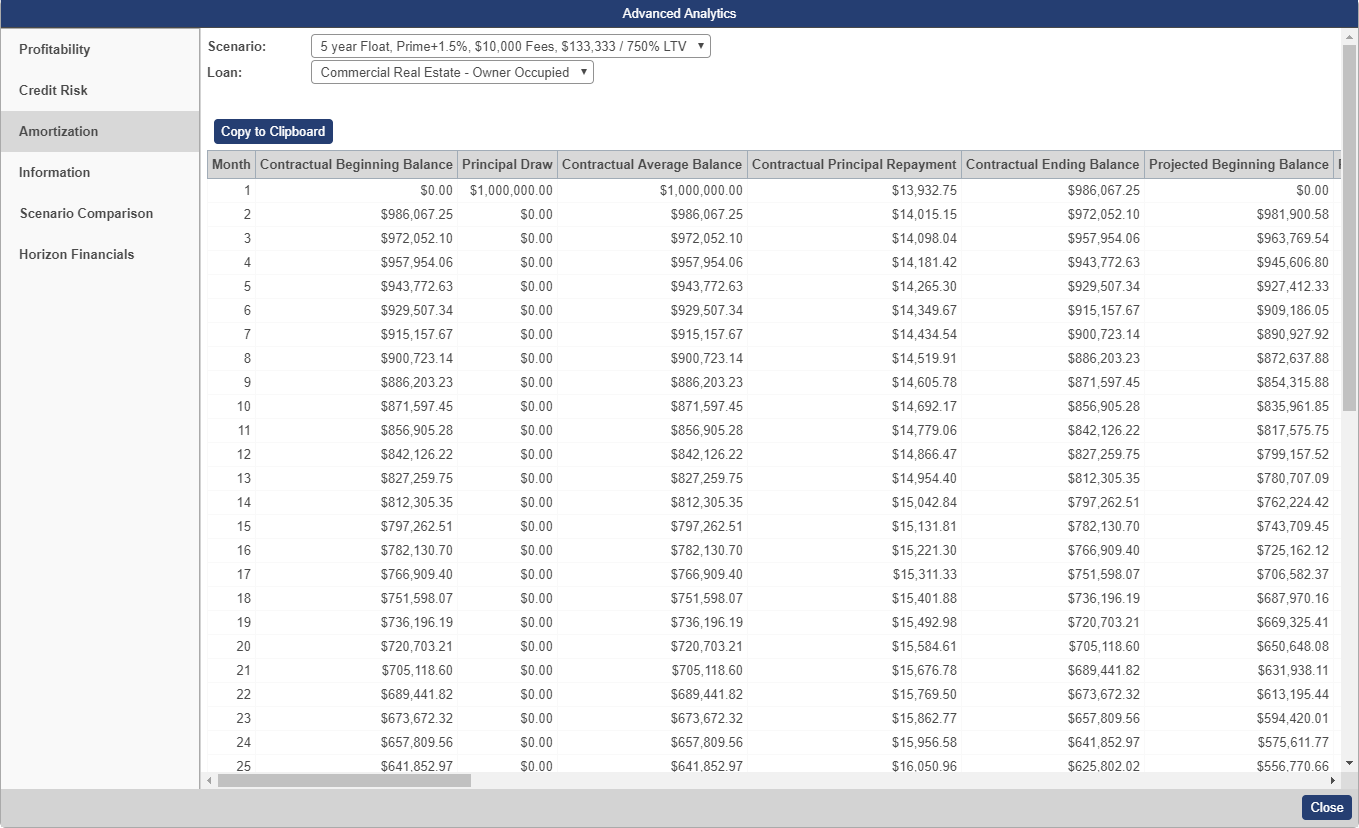

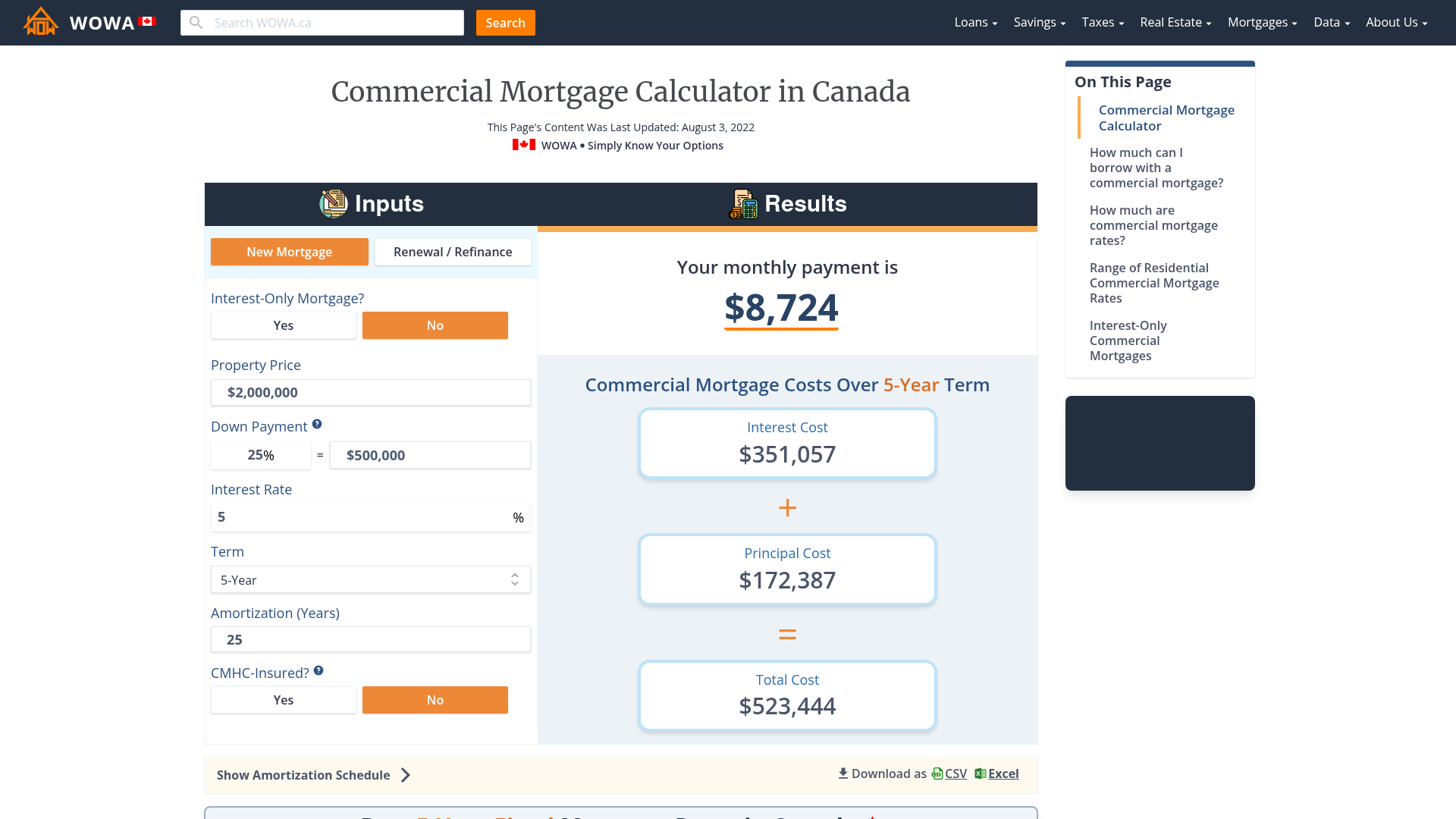

The interest paid on a commercial real estate loan will depend on the interest rate charged the length of the term and the amortization schedule.

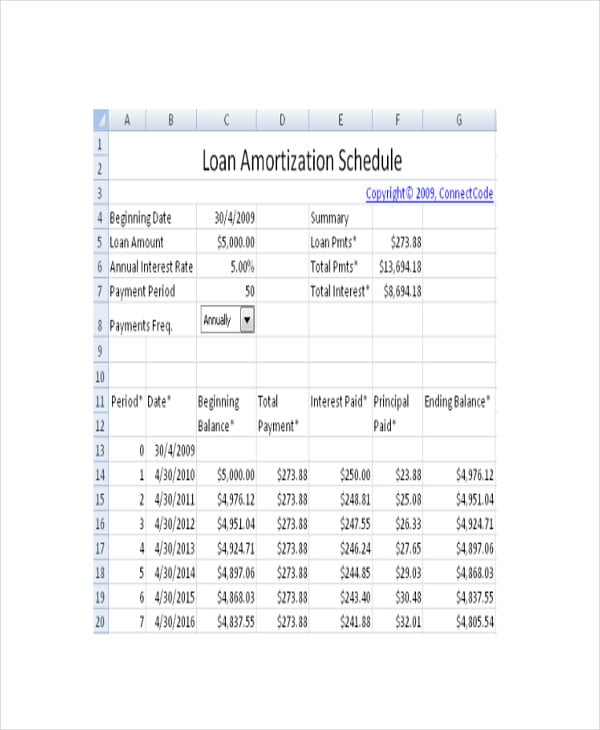

. Stay on top of a mortgage home improvement student or other loans with this Excel amortization schedule. Single Lump Sum Due at Loan Maturity. Additionally you will have the option to view and print a complete loan amortization schedule.

Renamed Loan Payment to Loan Payment Month 1 to clarify that the loan payment may change over the term. This calculator automatically figures the loan amortization period based on the desired balloon payment. Amortization of a Loan.

Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Even if interest rates are stable your rates and payments could change a lot. Additionally the term and amortization typically match on a residential loan ie.

The term sheet has nonbinding language allowing the lender to decline the request after going through its due diligence procedure. A better strategy is to use a business loan for your growth projects. A mortgage in itself is not a debt it is the lenders security for a debt.

Our easy-to-use web application can be installed on any website. Added input in cell U3 for Benchmark type eg. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Amortize C-R-E has designed an intuitive loan amortization web application with commercial real estate brokers in mind. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. 725 causing the borrower to have to refinance or payoff the loan or sell the.

To see the total interest charged over time for any type of commercial loan visit our calculator on this page and look at the Total Interest under the Payment Summary chart after inputting your. In most cases when a loan is given a series of fixed payments is established at the outset and the individual who receives the loan is responsible for meeting each of the payments. Of course you can always use a loan calculator to see exactly how term length affects the overall cost of your small-business loan.

The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. Use it to create an amortization schedule that calculates total interest and total payments and includes the option to add extra payments. Lets assume you took a balloon mortgage for a commercial property.

From April 2 through September 3 Celina must treat 20000 of the loan as used in the passive activity and 80000 of the loan as property held for investment. Many commercial loans or short-term loans are in this category. The loan amount is 800000 with an 8 percent APR.

Commercial Loan Amortization Calculator is used to calculate monthly payment for commercial loan payments with balloon payment. Our loan amortization application is designed to be functional fast and accurate while providing all the features our real estate clients need in one place. When you apply for a loan the bank will often charge a flat fee eg 500 or a percentage of the loan eg 3 to process the paperwork to start the loan.

The commercial loan calculator is easy to use with a commercial amortization schedule excel that you can view in details. Our business loan calculator will help you to calculate your monthly payments and the interest cost for financing your project. Most states in America do not require a commercial mortgage broker to obtain a mortgage brokers license or a real estate brokers license in order to negotiate commercial mortgage loans in their state.

Greatly from the rates and payments later in the loan term. It provides payment amounts for three different methods. This tool calculates payment amounts for a given commercial property.

Make amortization calculation easy with this loan amortization schedule in Excel that organizes payments by date showing. 3030 whereas the term of a commercial loan is usually shorter than the amortization ie. Commercial loan loan-to-value ratios generally fall into.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. To create an amortization schedule using Excel you can use our free. In the fields provided enter the dollar amount of the loan the annual interest rate attached to that loan the amortization term in years and the loan term in months.

Home financial. Youll commonly see commercial loan terms from 5 to 20 years. SOFR and forward curve for benchmark rate column T.

Unlike the first calculation which is amortized with payments. You must make the balloon payment by the end of the 3-year. If the APR is signifi cantly higher than the initial rate then it is likely.

Keep in mind that commercial loan term lengths can vary a lot depending on what kind of real estate youre buying with your mortgage loan. Banks call this the loans origination fee. If you want answers about your specific circumstances and what kind of rates you can expect contact Clopton Capital today for.

Commercial loans typically range from five years or less to 20 years with the amortization period often longer than the term of the loan. Created Variable Interest Rate section to track the periodic rate of variable rate loan. Loan amortization is the process of scheduling out a fixed-rate loan into equal payments.

The schedule shows the remaining balance still owed after each payment is made so you know how much you have left to pay. PI interest-only and balloon payments. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral.

An amortization schedule is a list of payments for a mortgage or loan which shows how each payment is applied to both the principal amount and the interest. There is an important difference between a commercial loan term sheet and a commercial loan commitment letter. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

A portion of each installment covers interest and the remaining portion goes toward the loan principal. A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. Get 247 customer support help when you place a homework help service order with us.

Depreciation and Amortization less Distributions and Withdrawals divided by the Current Portion of. Calculate the cost of a business loan. The amortization of a loan is the process to pay back in full over time the outstanding balance.

When it comes to commercial real estate loan rates for investment properties rates can range anywhere from 22 to 18 or higher depending on the specific loan. When you first look at the licensing scheme of most states the law will say something like A broker mus. If you want to amortize over a specific period of years.

Mortgage loan basics Basic concepts and legal regulation. Put the dollar amount in this field of the business loan calculator. If lenders or brokers quote the initial rate and payment on a loan ask them for the annual percentage rate APR.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

What Is A Principal Interest Payment Bdc Ca

What Is An Amortization Period Bdc Ca

Loan Structure Overview Components Examples

Understanding The Amortization Table Support Center

Commercial Loan Amortization Schedule How To Create A Commercial Loan Amortization Schedule Download This Co Amortization Schedule Commercial Loans Schedule

29 Amortization Schedule Templates Free Premium Templates

Loan Amortization Schedule With Variable Interest Rate In Excel

Loan Amortization Calculator Excel Template Payment Schedule

Loan Amortization Schedule Free For Excel

Loan Amortization Schedule Free For Excel

Loan Amortization Calculator Excel Tool Excel Template Etsy In 2022 Amortization Schedule Loan Excel Templates

Time Value Of Money Board Of Equalization

29 Amortization Schedule Templates Free Premium Templates

Free Interest Only Loan Calculator For Excel

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Bfiltqjc Ibeqm

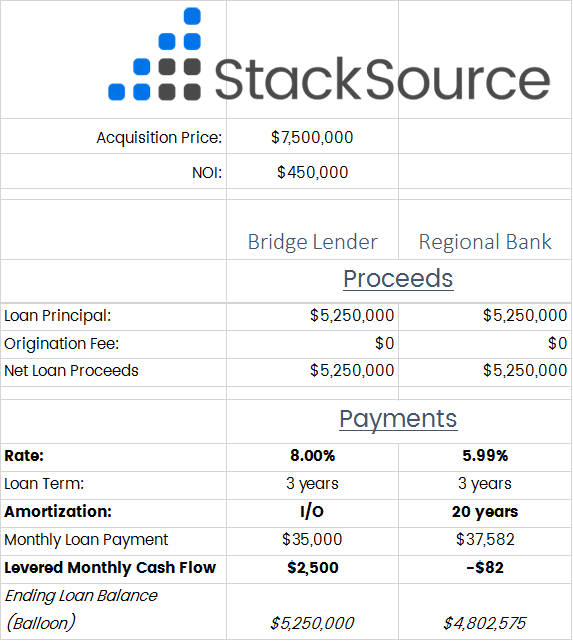

Commercial Mortgages Look At Amortization First By Tim Milazzo Stacksource Blog